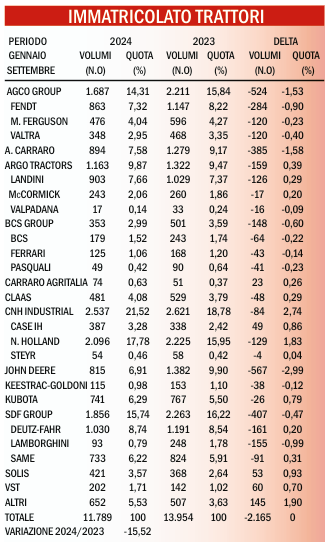

If it is true that numbers don’t lie, it seems that the tractor market crisis is slowly resolving. Compared to the terrible “minus 25.05%” at the end of March 2024, the registrations at the end of September have indeed recovered nearly ten points, closing at “minus 15.52%” with a trend of further improvement. This is also confirmed by the outlook of the European Agricultural Machinery Association, abbreviated as “CEMA.” Every month, they survey European entrepreneurs to assess their concerns and expectations, and in October, they noted a slight increase in companies expecting revenue growth over the next six months, rising from 12% to 21%. Things are not going well, in the sense that the crisis still exists and is biting, but the worst seems to be over, especially considering that Eima 2024 will take place in November, and many commercial expectations are tied to that event.

Moreover, in 2025, the three-year leases contracted by companies in 2022, when the market was booming thanks to government incentives that even manufacturers deemed excessive, especially those for the South, will expire. It is therefore likely that more structured companies will begin replacing their machines, a scenario that is less likely for the many family-run businesses that dominate the sector, as they lack the economic strength to closely follow technological developments in the industry. While waiting to see whether the recovery will solidify or not, it is interesting to observe the performance of the so-called “generalist brands,” whose rankings have changed significantly since the start of the year.

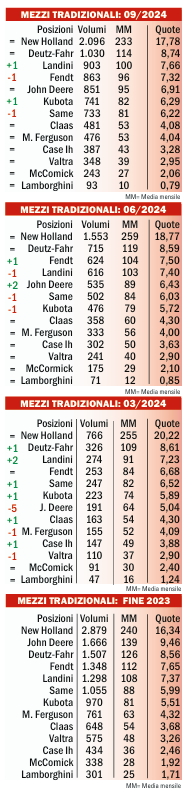

New Holland continues to dominate, but it is also losing market share; Deutz-Fahr is consolidating its position as vice-leader, and Landini returns to the podium at Fendt’s expense. John Deere’s struggles persist despite a recovery of two positions, while the battle between Kubota and Same continues, with the Japanese company overtaking the Bergamo-based brand after a nine-month chase. The following positions remain stable, though Case IH seems to have shifted into a higher gear, being the only generalist brand in clear growth. This is the exact opposite of Lamborghini, a brand that SDF has condemned to extinction, and it is behaving as such. Among the specialist manufacturers, there is a significant decline for Antonio Carraro, the steepest drop in volume in the entire sector, while the Asian brands Solis and VST are on the rise.

Title: Tractor market, something is moving

Translation with ChatGPT